We passed

a rate cap!

“No longer will people be turning and getting into debt traps, or balloon payments, where their ability to repay is not accounted for”

In Minnesota, the state legislature recently passed a law to cap interest rates on payday loans to 36% annually, from average annual interest rates in the state of 220% in 2022.

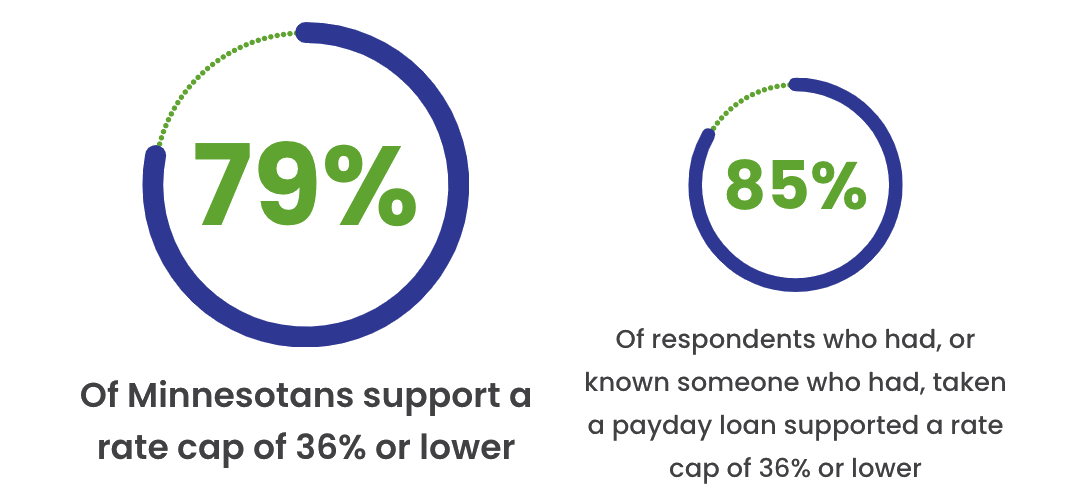

Minnesotans Agree:

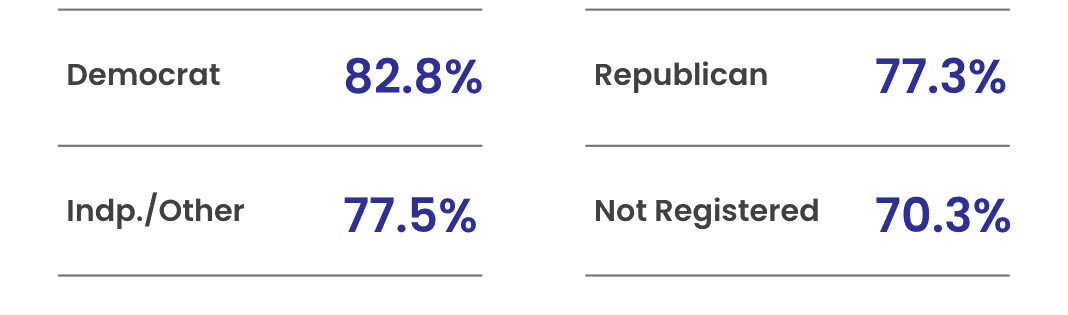

We built a non-partisan coalition!

The overwhelming support

for a rate cap is Non-partisan.

Regulatory Recap

Our Story

Minnesotans for Fair Lending (MFL) brings together organizations and their people to organize and advocate for reforming or eradicating predatory lending practices. With unwavering resolve, MFL stands at the forefront of a movement that seeks to bring about lasting change and foster a fairer, more just financial landscape.

Minnesotans for Fair Lending played a pivotal role in achieving a significant milestone for consumer protection in Minnesota: the successful passage of a state-wide interest rate cap in 2023. Through advocacy and strategic collaboration, the coalition effectively put an end to the deceptive and detrimental payday loans that have plagued vulnerable communities for far too long.

This legislative victory not only ensures the financial well-being of numerous individuals but also establishes Minnesotans for Fair Lending as a strong advocate in the ongoing fight against predatory lending practices.

Empowered by this legislative win, the coalition is well-positioned to build upon its success and pursue further legislative achievements aimed at dismantling the exploitative nature of predatory lending. We believe that everyone is entitled to just, equitable and responsible financial products and we will continue to advocate alongside Minnesotans directly impacted to put an end to the predatory practices of lenders.

Head to the "Take Action" page to learn more about our current legislative efforts.

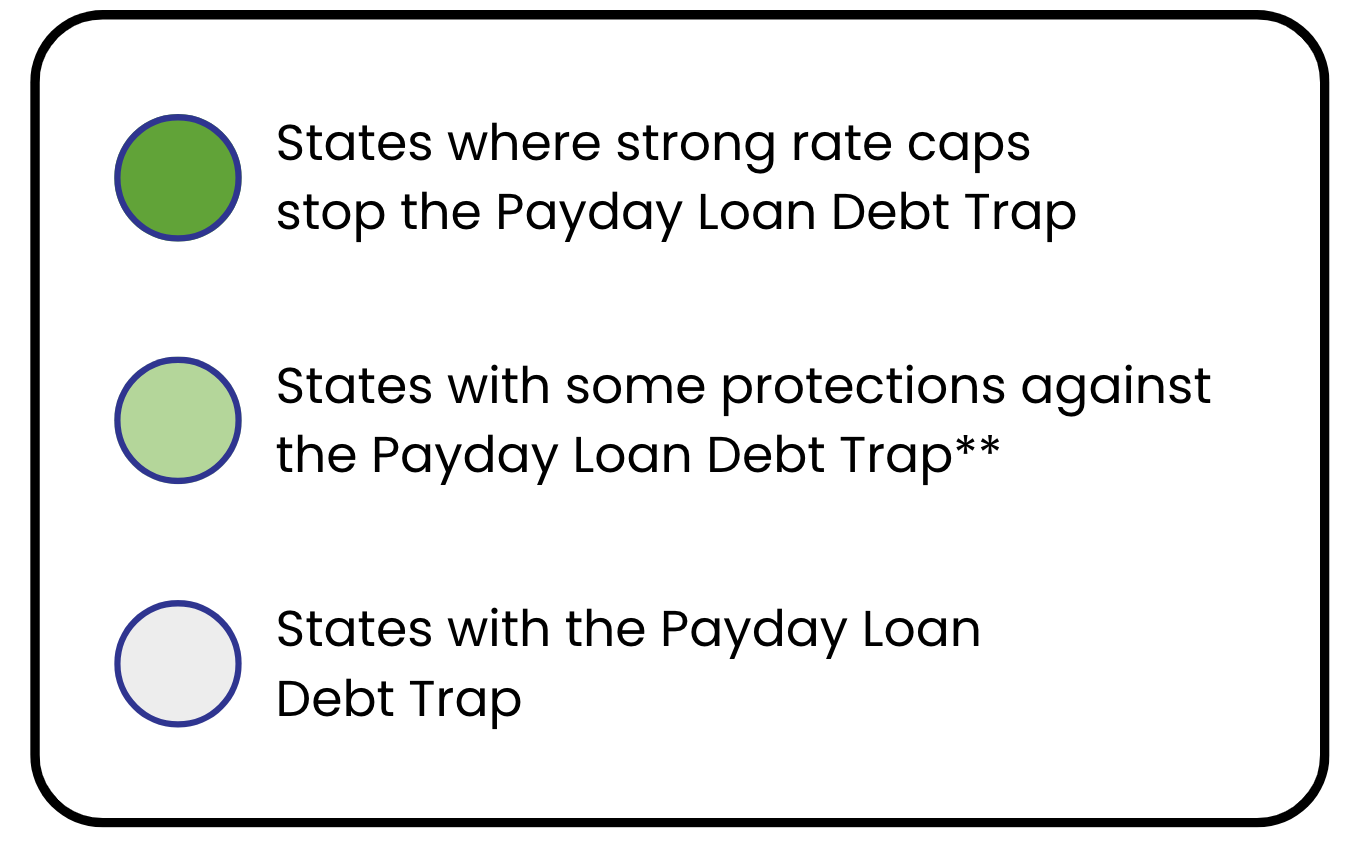

U.S. Payday Lending Regulations By State

**States with some protections include term limits longer than 14 days (NM, OH, OK, OR, VA), limits on fees (OR,ME), and/or number of loans per borrower (WA).

Click on a state to read more about their efforts to end the Payday Loan Debt Trap.